The S&P 500 touched bear market territory during a volatile May, down over -20% from its high intra-day on May 20th. Stock investing can be volatile, but nearly a century of bull and bear markets show the good times have outshined the bad times. From 1926 through 2021, the S&P experienced 17 bear markets, ranging from -21% to -80% across an average length of around 10 months.

On the upside, there were 18 bull markets, averaging 55 months in length and advances from +21% to +936%. When the bull and bear markets are viewed together, it’s clear that stocks have rewarded disciplined investors. (1)

Drivers of this Bear Market

2022’s bearish market has been driven by a confluence of factors mostly related to persistently high levels of inflation and the anticipation of the Federal Reserve’s inflation fighting measures, which will be necessary to rein in prices.

- Russia’s invasion of Ukraine is tragic on an increasing number of fronts. Economically, it has exacerbated supply issues, especially in commodities such as oil and gas, as well as food and certain minerals.

- COVID-19 outbreaks in China and subsequent lockdowns in multiple cities are further disrupting global supply chains relying on components, parts and products manufactured in China.

- A tight labor market in the United States and globally is typically good news. This market is so tight, however, with two job openings for every unemployed person, the labor market is further exacerbating inflationary pressures in the economy.

- Demand has surged — first for consumer goods such as appliances and furniture — and now for travel and leisure spending, following the rollout of vaccines and people getting back into society and the economy. Surging demand with a severely constrained supply has led to rising inflation in a textbook fashion.

- By mid-May, observers began seeing inflationary pressures affecting companies bottom lines even more negatively than expected. Earnings reports from Wal-Mart and Target, in particular, revealed high inflation across many aisles of their stores. Eventually, high levels of inflation will lead to a pullback in spending, or demand destruction, across the economy for the U.S. consumer. Consumer spending accounts for two-thirds of U.S. GDP and is critical to markets and the economy.

Are We Headed for Recession?

Importantly, as investors, we are always some time away from the next recession, or two consecutive negative quarters of GDP growth. In our view, important questions to ask include:

- Do structural risks or systemic excesses exist that could affect the severity or depth of a growth downturn? (For example, the mortgage driven credit crisis across banks and the financial system that preceded the Great Recession.)

- How much of a potential growth slump is currently priced into markets?

There is surely escalating risk that tightening monetary conditions, along with the highest levels of inflation in decades, could lead to a drop-off in demand and consumer spending that could lead to a recession in the coming quarters.

Right now, however, many measures of consumer demand are solid, and the unemployment rate is hovering near all-time lows. Many strategists suggest a shallow recession sometime in the latter half of 2023 and into 2024 could be in some ways healthy for an economy that didn’t have much time to reset inefficiencies or excesses as a result of the COVID-induced, and rather quick, 2020 recession.

Also, with markets already near bear-market territory, many suggest a fair amount of a moderate growth slowdown in the medium term is priced into markets at current levels. Importantly, recessions are notoriously difficult, if not impossible, to consistently and accurately time, and in many cases are triggered by a surprise or unexpected development or event. At this time, obvious systemic bubbles or excesses that could spread in a growth slowdown and lead to a particularly severe recession are not clearly apparent in our view, but we are regularly watching for developments.

What About Bonds?

One factor that has made the 2022 bear market different and, in some ways, more painful than others is that it has occurred in an inflationary and rising interest rate environment. As interest rates and yields go up, the prices of existing bonds go down. In the first quarter of 2022, the bond market had one of its worst quarters in decades. With bonds going down along with stocks, the typical diversification and risk buffer benefits to bonds was not observed in early 2022.

On a positive note, this sort of negative move in bonds is highly unusual and is the result of the exceedingly rapid reversal of the Federal Reserve’s posture on interest rates and inflation. With the 10-year treasury peaking a bit above 3% and recently softening, much of the pain for bond investors is expected by many to have been priced in at this point.

What investors have now are some of the more attractive yields in years for bonds and CDs, especially at the front end of the yield curve. Unlike stocks, whose forecast includes much wider possible outcomes and is more uncertain, many expect much of the worst has been felt in bonds at this point, and that the asset class is now more attractive than in the recent past.

What We Are Doing

NCTC’s Investment Committee meets regularly to assess portfolio positioning, economic developments and market conditions. Recent portfolio rotations and recommendations have included:

- Modest tilt toward value companies and away from growth. Value companies, which tend to have more quality cash flows and profits, and return capital via dividends, are expected to perform better in this inflationary and rising interest rate environment.

- Maintain global diversification, but modest overweight to United States. With a war in Europe, elevated uncertainty across the globe, and a strong U.S. dollar, we remain moderately overweight to U.S. equities, generally targeting 75% U.S./25% international. Valuations in global markets remain attractively priced, however, and we continue to believe that some ongoing diversification globally is important.

- Moderately reduced duration in bond portfolios. Shortened duration in our bond portfolios allows bonds to mature sooner and be reinvested at what are now higher rates. Shortening durations help reduce interest rate risk, or the risk and magnitude of price losses in bonds as interest rates go up.

Advice for Investors

For long-term investors, our advice remains mostly consistent with the best practices we often suggest during periods of volatility and uncertainty.Evaluate if things have changed for your situation. Investor data has shown that it’s often when the urge to take action and de-risk a portfolio is strongest, the benefit of such trading is weakest. We encourage investors to only make major changes to your asset allocations or portfolios if there are major changes to your goals or situation, not based on short-term market swings, which can occur rather frequently.

- Remain diversified. Certain industries and sectors will zig while others zag in markets, and this is especially true in times of volatility. The worst of the market weakness from inflation, rising rates, and the Ukraine crisis has been concentrated in certain sectors like high-growth stocks and geographies such as emerging markets. Investors are encouraged to remain broadly diversified and avoid concentrations in any one area.

- Maintain context. For diversified investors whose situation has not changed, and who have a healthy cash reserve, we encourage maintaining an outlook consistent with your time horizon. Long-term investors will face many corrections, crises, and bull markets over their investment horizon. We encourage focusing on what you can control and sticking to a prudent plan.

- Stay the course. The stock market’s ups and downs are unpredictable, but history supports an expectation of positive returns over the long term. For the best shot at the benefits the market can offer, we recommend staying the course.

Final Thoughts

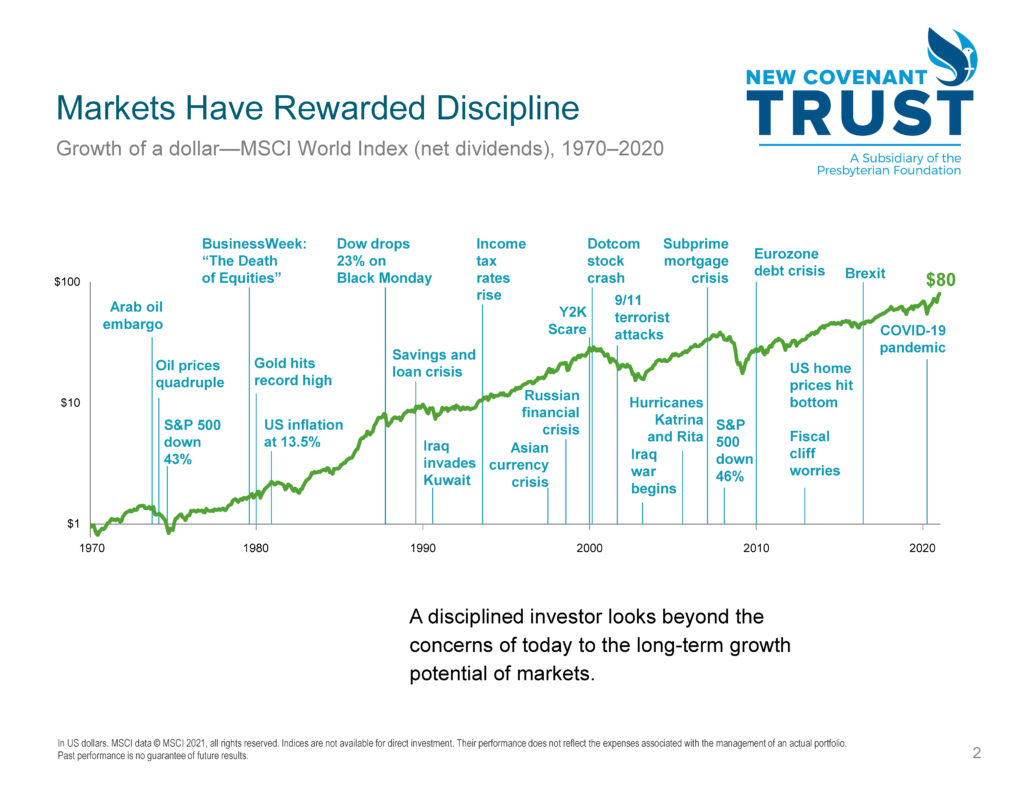

For long-term investors, the below chart (2) may provide helpful context for our advice to stay the course. It shows $1 invested in the global stock market over 50 years. Despite several recessions and dozens of crises, the $1 invested grew to $80. We still believe the capital markets will reward investors over the long term.

We continue to actively monitor the markets and economic indicators to bring you the most up-to-date information and guidance. Please don’t hesitate to reach out to us with any questions at 800-858-6127, Ext. 6.

- Adapted from Dimensional Fund Advisors- Bulls, Bears, and Long-Term Benefits of Stock Investing. 04/2022

- Source: Dimensional Fund Advisors